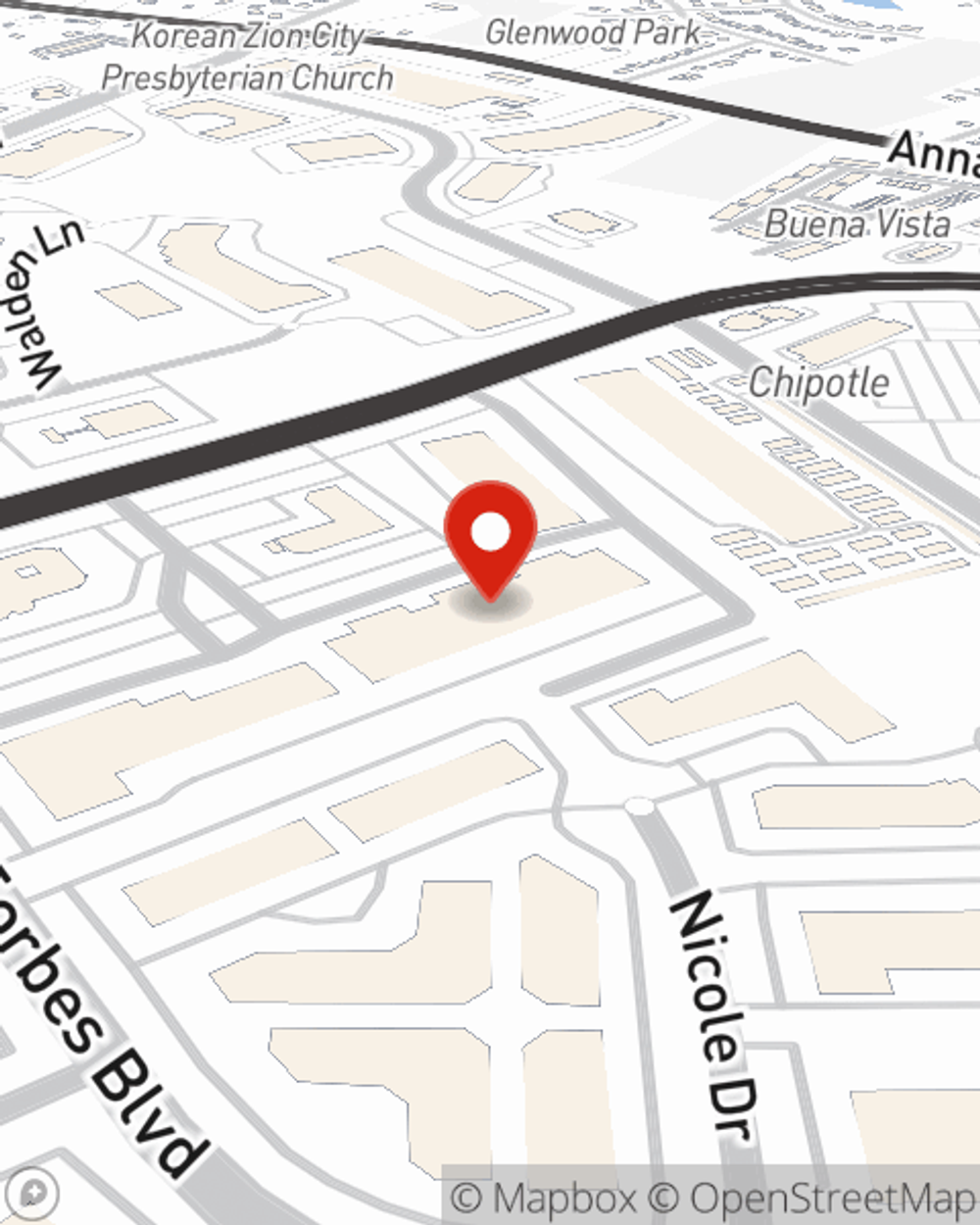

Business Insurance in and around Lanham

Looking for small business insurance coverage?

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide outstanding insurance for your business. Your policy can include options such as a surety or fidelity bond, worker's compensation for your employees, and extra liability coverage.

Looking for small business insurance coverage?

This small business insurance is not risky

Small Business Insurance You Can Count On

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent James Allen for a policy that protects your business. Your coverage can include everything from errors and omissions liability or business continuity plans to mobile property insurance or commercial auto insurance.

Reach out agent James Allen to learn more about your small business coverage options today.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

James Allen

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.